This article was co-authored with Hannah Duke.

Following two years of design, development and consultation through an open innovation process, the Taskforce on Nature-related Financial Disclosures unveiled its final recommendations (TNFD Recommendations) at the New York Climate Week.

As we have previously reported here, the TNFD Recommendations aim to balance the complexities of science with practical guidelines and recommendations, in order to enable organisations to implement cost-effective action to assess and address nature impact.1 This milestone represents a practical way for organisations of all sizes to consider how their activities impact nature by providing a risk management and disclosure framework to identify, assess, manage and, ultimately, disclose nature-related issues.

Overview of the TNFD Recommendations

The TNFD Recommendations are a voluntary system which build on the Task Force for Climate-Related Financial Disclosures (TCFD) recommendations,2 and are consistent with the International Sustainability Standards Board’s (ISSB) and the Global Reporting Initiative standards. The TNFD Recommendations are also aligned with the Kunming-Montreal Global Biodiversity Framework (GBF),3 which was released in December 2022 wherein almost 200 countries committed to ambitious goals and targets to reach the global vision of a world living in harmony with nature by 2050. Specifically, the TNFD Recommendations are consistent with Target 15 of the GBF which calls for assessment and disclosure of nature-related risks, impacts and dependencies.

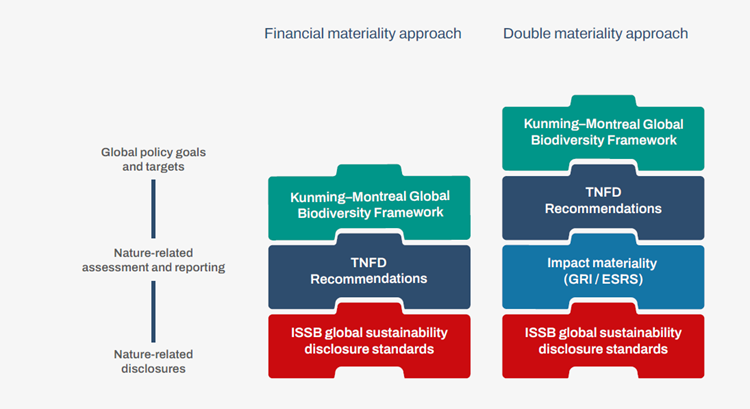

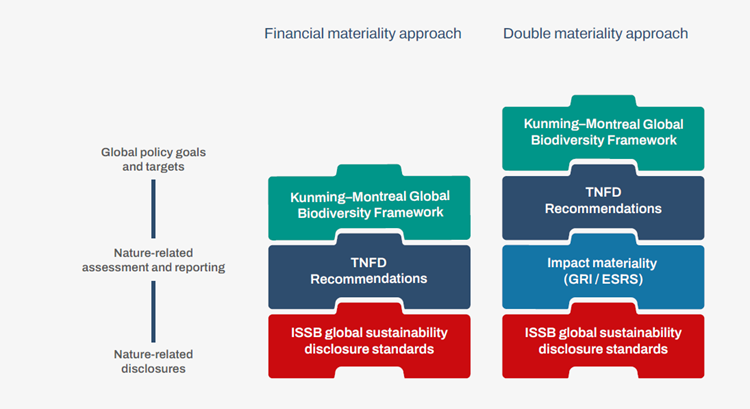

The alignment with global goals and the global reporting baseline is depicted below, with the double materiality approach referring to a two-way interaction with nature. The common aim among the different goals, recommendations and standards is to demonstrate the interconnectedness between nature impacting an organisation and its operations, with a long term view of minimising adverse impacts to nature through disclosures.4 The thesis is that which gets measured, gets managed.

Figure 1: The interconnections between the different global frameworks, TNFD recommendations and standards.

Why are the TNFD Recommendations important for organisations and for the planet?

The TNFD Recommendations emphasise that business-as-usual is not an option as organisations can no longer consider nature as a corporate social responsibility issue.5 Instead, it is “a core and strategic risk management issue, alongside climate change”.6

The TNFD Recommendations emphasise that nature-related risks and opportunities have financial effects for an organisation through changes to revenue, expenses and capital expenditure, access to and cost of capital and carrying amount of assets and liabilities on the balance sheet.7

Despite nature loss posing both a growing risk to organisations as well as offering opportunities, to date, organisations have largely considered nature as an unlimited and free provider of critical inputs into operations and value chains, and have therefore been inadequately accounting for nature-related dependencies, impacts, risks and opportunities.8

The timing of the release of the TNFD Recommendations is also of importance as it comes as at a crucial time. Policymakers, regulators, asset owners and managers as well as leading global companies are waking up to the need to rapidly focus on and invest in nature-related risk management. Accordingly, organisations have a critical role to play with the importance of the TNFD hinging on the mobilisation of private sector engagement and finance to tackle nature loss and scale-up nature-based solutions.

TNFD Key Concepts

The TNFD framework consists of conceptual foundations for nature-related disclosures, a set of general requirements and a set of recommended disclosures.

General Requirements

The TNFD Recommendations include six general requirements which are additional to the general requirements and other provisions of the ISSB’s International Financial Reporting Standards on sustainability-related financial information. The general requirements apply to all four pillars of the recommended disclosures and describe:9

- the application of materiality;

- the scope of disclosures;

- the location of nature-related issues;

- integration with other sustainability-related disclosures;

- the time horizons considered; and

- the engagement of Indigenous Peoples, local communities and affected stakeholders in the identification and assessment of the organisation’s nature-related issues.

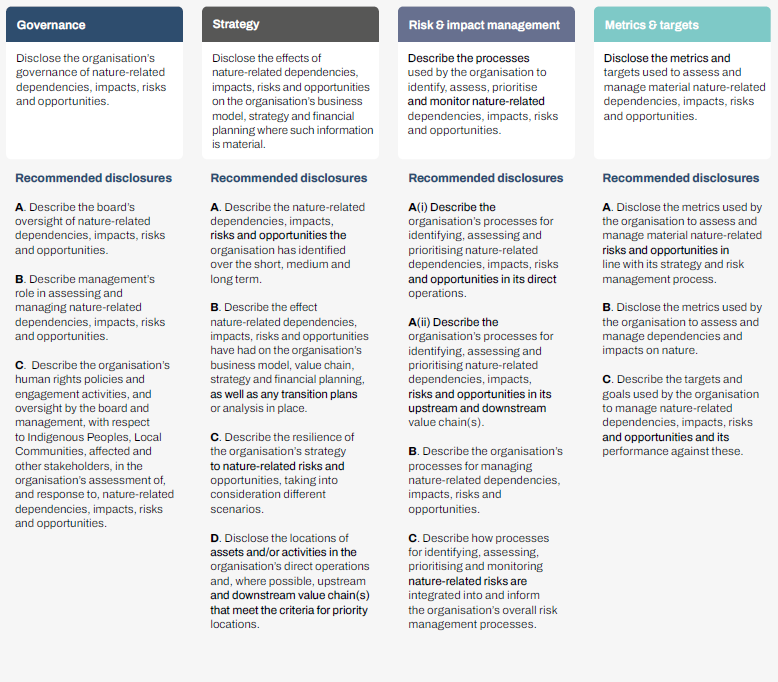

Recommended Disclosures

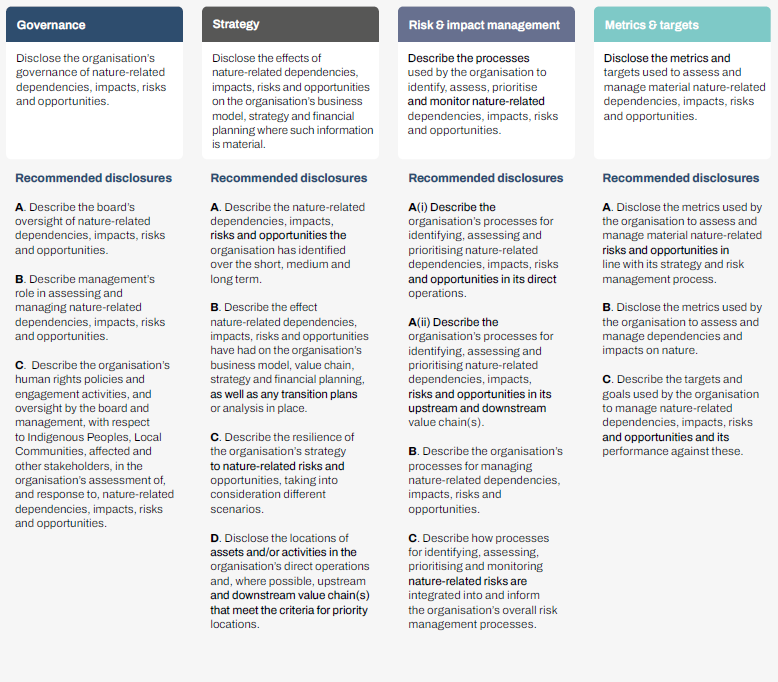

The 14 recommended disclosures outlined below are science-based and voluntary recommendations for all sectors and are grouped into the same four pillars as the TCFD.

Two new recommendations feature in the final TNFD Recommendations compared to the initial draft. They are:

- the recommendation to describe human rights policies and engagement activities with respect to Indigenous Peoples, local communities and affected stakeholders; and

- the recommendation to describe the processes for identifying, assessing and prioritising nature-related risk, which was split between an organisation’s direct operations and an organisation’s upstream and downstream value chain(s).

Interestingly, the draft TNFD Recommendations mentioned the disclosure of Scopes 1, 2 and 3 emissions under Metrics and Targets.10 To clearly differentiate from the TCFD, this recommendation was not adopted. Instead, it was replaced by the need to disclose the metrics used to assess and manage dependencies and impacts on nature.

These key developments portray the complexity of identifying and assessing nature-related issues in relation to people (and likely risks to human rights due to nature change), organisational activities demonstrated by a value chain, and key dependencies and impacts that can be measured.

Figure 2: TNFD’s recommended disclosures.

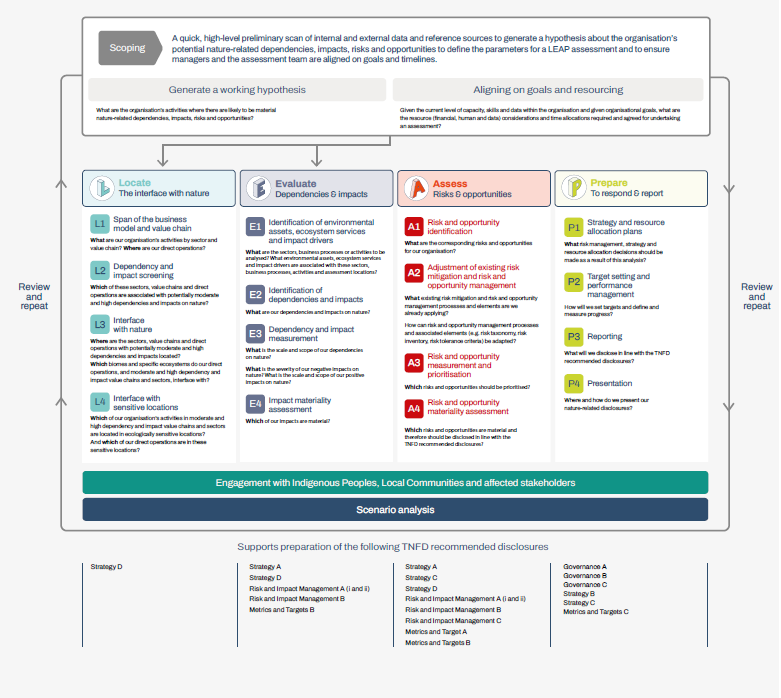

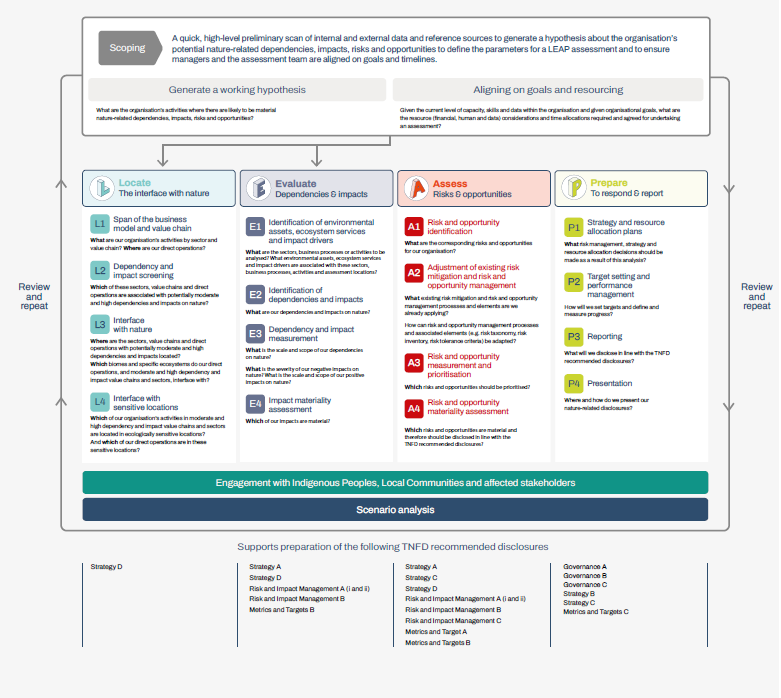

The LEAP approach and additional guidance

An organisation’s ability to disclose material nature-related issues is determined by its knowledge of its value chain as well as its capacity to identify and assess its nature-related issues. Given the complexity of value chains, particularly for larger organisations, the first step in undertaking a TNFD assessment is setting a clear and realistic scope of an organisation’s activities from which data of material nature-related dependencies would be generated.

To assist organisations in identifying, assessing and, ultimately, disclosing their nature-related dependencies, impacts, risks and opportunities, the TNFD released additional guidance which uses the LEAP approach. The LEAP approach involves four phases of assessment which are:

- Locate the interfaces with nature across geographies, sectors and value chains;

- Evaluate dependencies and impacts on nature;

- Assess nature-related risks and opportunities to the organisation; and

- Prepare to respond to nature-related risks and opportunities, including reporting on material nature-related issues to the primary users of financial reports and other stakeholders, aligned with the TNFD’s recommended disclosures.

Figure 3: TNFD approach for identification and assessment of nature-related issues - LEAP.

The LEAP approach is designed to be used by all sectors and biomes. An organisation may use the LEAP approach to identify and assess material nature-related issues, but it can ultimately use a different method altogether such as existing nature-related frameworks like the Natural Capital Protocol and the Science Based Targets Network methods for nature.11

Additional Guidance

Sector Guidance

In addition to the TNFD Recommendations, specific sectors may also use the TNFD’s additional sector guidance which was developed following the Sustainability Accounting Standards Board’s standards and the EU’s Sustainable Finance Disclosure Regulation (SFDR). Using financial institutions as a pilot, the additional sector guidance provides a range of proposed TNFD disclosure metrics that present SFDR principal adverse impact equivalents for each driver of nature change.12 For instance, if a financial institution invested in a containers and packaging company, the potential for plastic pollution and non-GHG air pollutants could be measured by total weight (tonne) or by type (Nitrogen Oxides). While the guidance uses financial institutions, other sectors will be able to use the same SFDR principal adverse impact equivalents for their own nature-related assessments.

The final version of the additional sector guidance for financial institutions is expected to be published in 2024. TNFD welcomes feedback on the proposed disclosure metrics for financial institutions as outlined in the additional sector guidance to further develop data and improve usability.

Biome Guidance

The TNFD also released an additional biome guidance (or location-specific, ecosystem guidance), which maps organisational activities that rely on ecosystem services and how such organisational activities would be impacted if the ecosystem services are disrupted or changed in the future.

Biomes are types of ecosystems that exist in different locations around the world such as tropical forests. These biomes provide an ecosystem service that organisations and communities may use or rely on. For instance, an ecosystem service such as rainfall pattern regulation helps crop farmers produce crop yields, thereby attaining food security and business revenue. The poor future state of these biomes due to climate change can adversely impact ecosystem services. Ultimately, the change in ecosystem service is a material risk for organisations and communities that rely on such ecosystem services.

The additional biome guidance provides a “sector-to-biome” mapping to demonstrate how value chains interact with biomes and, therefore, ecosystem services.13 Organisations should refer to this guidance in considering their value chain and organisational processes and activities that have impacts and dependencies on nature in order to determine the relevant biomes. After relevant biomes are identified, the LEAP approach may be used in order to identify and assess the specific implications to an organisation’s activities depending on the organisation’s degree of connection and control.

Engaging with Indigenous Peoples, local communities and affected stakeholders

While all humans are “right-holders” to nature according to the Universal Declaration of Human Rights, there are specific communities that are at risk of being impacted or are already impacted by an organisation’s activities that adversely impact nature and ecosystem services. Therefore, meaningful engagement with First Nations and communities that depend on nature for their lives and livelihoods is fundamentally critical in identifying and assessing an organisation’s nature-related issues.

TNFD’s guidance on engagement with Indigenous Peoples, local communities and affected stakeholders builds on existing international law and best practice international standards, such as the UN Declaration on the Rights of Indigenous Peoples and the UN Guiding Principles on Business and Human Rights. This guidance provides a list of disclosures that organisations should include to meet the TNFD’s general requirements. For instance, these disclosures could be:14

- a description of how human rights due diligence, including covering rights of Indigenous Peoples and Local Communities, are embedded in an organisation’s strategy, policies, codes of conduct, governance structures and best practices;

- the engagement processes undertaken that demonstrate how free, prior and informed consent has been obtained;

- the results of the engagement process with Indigenous Peoples, local communities and affected stakeholders, including how these results are incorporated or addressed in the materiality assessment and decision-making;

- a statement of whether or how senior management and the board are informed about engagement processes with Indigenous Peoples, local communities and affected stakeholders.

This guidance also provides a set of questions which could be used throughout the LEAP approach when engaging with Indigenous Peoples, local communities and affected stakeholders. Additionally, it provides a series of relevant legislation and guidelines for conducting cultural, environmental and social impact assessments.

Implications for organisations

While Australian regulators have not yet commented at length about their expectations for TNFD, much of the recent discourse from regulators such as ASIC and the Department of Climate Change, Energy, the Environment and Water (DCCEEW) had been welcoming.

In June 2023, ASIC chair, Joe Longo, warned professional services about the seismic expectation for organisations to collect and analyse data for ESG, climate change and nature amid the changing regulatory framework in favour of reporting on environmental protection.15 He highlighted the need for companies to reflect on and review governance standards to ensure stronger support for disclosure. Finally, in preparing disclosures, he warned about inaccurate labelling and the use of vague terms that are not founded on reasonable grounds that may be akin to greenwashing and other sustainable finance misconduct, which ASIC will investigate and undertake enforcement action as required.16

DCCEEW also supported the release of the TNFD Recommendations as a strategic funding partner. In 2022, DCCEEW hosted a series of workshops with industry bodies to pilot case studies to test the application of the draft TNFD framework in Australia. Using a value chain approach, the case studies covered the following real economy scenarios:17

- Critical mineral monitor for producing clean energy technologies;

- Natural gas extraction for industrial manufacturing;

- Domestically sourced fresh beef and salmon sold at a supermarket;

- Property development and building construction; and

- Domestic cultivation of cotton for export.

These case studies demonstrate how organisations might undertake voluntary nature-related risk and opportunity assessments, including the kinds of challenges, enabling tools, data and resourcing requirements and example outputs that organisations might expect to have or use in preparing their TNFD reports.

Other countries have also followed suit in piloting the TNFD framework. In Canada, 27 organisations from mining companies to commercial banks have undertaken a TNFD assessment. While it is unlikely that TNFD will be put into wide use quickly in Canada, piloting the TNFD Recommendations have allowed Canadian organisations to build knowledge and capability in identifying and assessing their impacts to natural assets.18

With the decision to mandate the TCFD still in consultation, the Australian government is yet to determine whether it would also mandate the TNFD. Nevertheless, the recent release of the ISSB standards and the TNFD Recommendations point to a clear direction towards responsible reporting on climate and nature-related risks and opportunities.

The need for informed, professional, commercial and nature-attuned legal guidance has never been more critical. As a global law firm that has deep expertise in climate change, environment and ESG, our Risk Advisory and Environment and Planning practices can help get your organisation prepared. Please reach out to our team if you need assistance with understanding how the TNFD will impact your organisation.